I don’t remember how I discovered SensibleInvesting.TV and its landmark video series, “Passive Investing: The Evidence.” But I do remember my reaction when I did: Eureka! It was one of the first times I knew that US and UK investors alike had sensible proponents of evidence-based (formerly “passive”) investing, to help them find their way in our grueling global markets.

The respect is clearly mutual. The series features some of the same familiar voices we’re used to heeding here in the states – so familiar that their surnames usually suffice: Bogle, Sharpe, Fama, French, Bernstein (William, that is), Malkiel, Ferri, Goldie … And Swedroe, Larry Swedroe, who has both shaken and stirred the financial community many times over with his collection of investment books for helping everyday investors discover evidence-based investing.

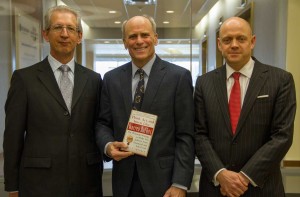

Imagine my delight when I learned that Sensible Investing’s founder and host Richard Wood and his colleague Igors Alferovs had recently collaborated with Larry to publish a British version of one of his most popular books: “Think, Act and Invest Like Warren Buffett.”

I was pleased when Richard and Igors agreed to share with me their experience advocating evidence-based investing in the UK. Here are the results. (Additional book ordering information is below, if you are interested in obtaining a copy of Larry’s Anglicised book for you or your clients.)

What is Sensible Investing? When did you found it and why?

Sensible Investing is an online video channel and information website featuring film, articles and comment about evidence-based, or passive investing. We began it in 2012 while we were making our documentary Passive Investing: The Evidence, and realised there was a gap in the market for independent, impartial, fact-based information about investing. This was especially the case in the UK, which was (and still is) years behind the US in awareness of the true cost of traditional active investing. An online channel for videos, blogs and downloads, combined with an active social media presence, seemed to be the best way of reaching as many people as we could. Although it’s funded and run by our wealth management firm BRWM, we are committed to keeping it as independent as possible, and are happy to feature content from other organisations who share our beliefs. Continue reading “A Sensible Shot Heard Around the World: An Interview with UK’s Sensible Investing Hosts”

Calling All Evidence-Based Advisors!

Calling All Evidence-Based Advisors!